The year 2023 began with low expectations for global economic growth and heightened fears of a recession, but various factors like China’s reopening, significant fiscal stimuli in the U.S. and Europe, and the persistent strength of U.S. consumers helped stabilise growth. This, along with optimism driven by ChatGPT, luxury goods, weight-loss drugs, anticipated Federal Reserve rate cuts, and a bitcoin rally, positively influenced risk markets. This was despite major challenges like significant interest rate hikes, wars, an energy crisis, a regional banking crisis, and economic downturn discussions. Some economists have flagged potential declines in inflation and economic demand in 2024, the result of which may lead to investor concern. This highlights the potential for downside risks to dominate over euphoria.

Heading into 2024, the global economic and political outlook is marked by significant uncertainty. The current economic situation is a catch-22: sustainable risk asset rallies require reduced interest rates and easing monetary policies, which may only happen if there’s a market correction or inflation decline due to a weaker demand. Key questions being asked include the impact of rapid advancements in artificial intelligence on business operations and identifying the potential winners in the AI race. Another area of focus is the energy transition, particularly whether electricity, wind, and solar power will replace fossil fuels as the primary energy sources and the timeline for such a shift. In the bond market, with U.S. Treasury yields at a 16-year high, there is a speculation that this might signal a historic opportunity for real income returns in the fixed-income sector.

However, potential risks loom on the horizon. Concerns include the impact of rising government debt on economic growth, the effects of escalating U.S. and China tensions on global trade, the possibility of conflicts in Ukraine and the Middle East escalating, and the impact of a pivotal U.S. election year on market volatility. Despite these uncertainties and potential for volatility, the current climate is seen as a prime time for active investing, offering both significant challenges and unprecedented opportunities. This complex scenario sets the stage for the 2024 Outlook report, highlighting the need for careful analysis and strategic investment decisions in a rapidly changing environment.

“Reflation, not recession” provides an optimistic outlook for global and Australian economies, predicting stronger growth and easing inflation in 2024. There are five key reasons for this positive forecast:

- Emerging Markets Driving Global Recovery: Emerging markets, notably India, Vietnam, Mexico, and parts of emerging Europe, have spearheaded a substantial recovery in global production. This momentum, which began before mid-2023, has continued into the later months, offsetting the slight drag from developed markets.

- Excess Credit as a Growth Catalyst: Despite central bank tightening in the West and ongoing quantitative tightening, credit growth continues to outpace economic growth in major economies. This trend historically indicates future economic expansion.

- Anticipated Interest Rate Relief: The U.S. is expected to reach its inflation target by April 2024, prompting a potential easing cycle from the Federal Reserve starting in May 2024. However, the scope for significant interest rate reductions is limited due to the minimal spare capacity in product and labour markets.

- Quantitative Tightening (QT) Coming to an End: The Federal Reserve and the Bank of England are expected to conclude their QT programs in 2024. This change, along with shifts in policies in Europe, Australia, and China, signals an end to the economic drag caused by QT, offering cyclical support for the recovery.

- China’s Economic Strategy Shift: China has taken steps to stimulate its economy, including expanding its budget deficit and enhancing local government liquidity facilities. These measures, coupled with a less confrontational stance towards the West, are expected to support a sustained domestic economic recovery.

The global economy is expected to undergo significant changes in the coming years, with trends emerging that investors may not be adequately recognizing. The rising interest rates and reconsideration of risk premiums are leading to reduced liquidity, affecting investment flows, and causing potential dislocations in various asset classes. These market changes may create opportunities for informed investors. Meanwhile, with a significant amount of money in low-risk, short-duration investments, investors seem to be waiting for the right moment to diversify their portfolios, likely adopting a conservative approach initially. Active management and thorough fundamental analysis are crucial in this evolving market landscape, as they enable investors to identify and capitalize on emerging trends and undervalued sectors. Such strategies are essential for navigating the changing market conditions and seizing investment opportunities in times of uncertainty and change.

For Australia, the outlook is similarly positive, with expectations of avoiding a recession and experiencing accelerated growth in 2024. Several factors support this view:

- High commodity prices and construction backlogs have sustained economic growth.

- Household assets have grown, offsetting the impact of interest rate hikes.

- Increased net immigration has bolstered population growth, supporting the economy.

- Inflation moderation is expected to drive rate cuts, further stimulating growth.

Locally, the forecast for the Australian economy and equity market in 2024 is positive, with some economists expecting economic growth to average 2.25%, bond yields to stabilize, and a strong performance in sectors like Industrials, Materials, Financials, Technology, and REITs.

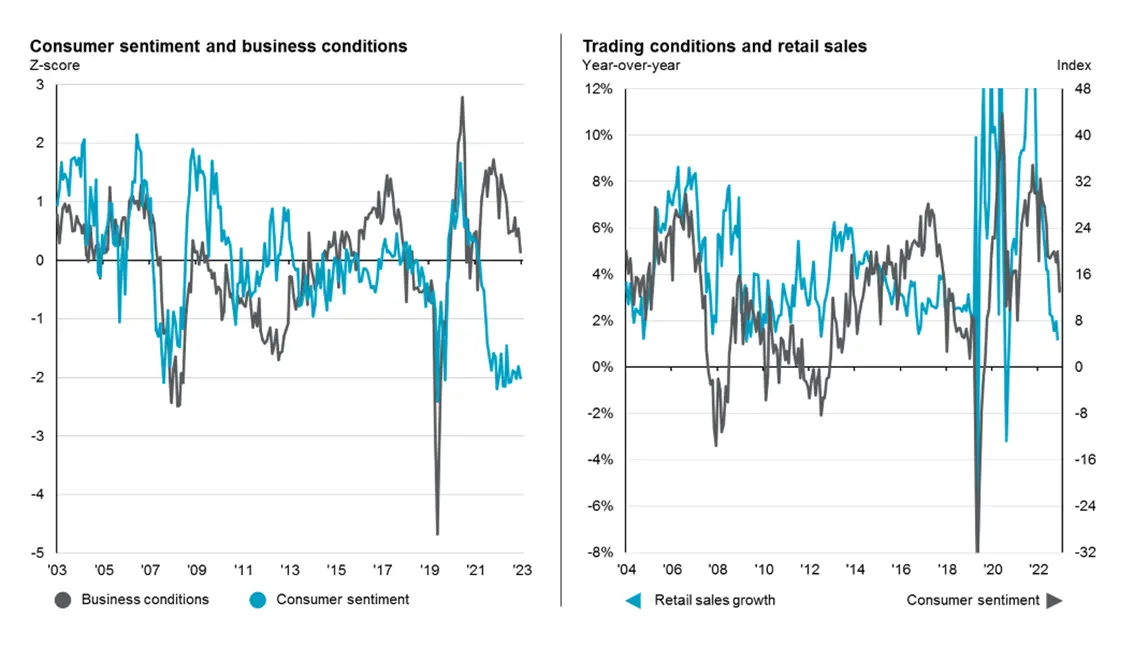

This contrasts with the fourth quarter 2023 consumer sentiment and business sentiment, which are both slightly negative to December 31.

From a Year-on-Year perspective, retail sales are lagging and following the same direction as consumer sentiment. Both point to the views held by consumer and business, that the effects of inflation and higher interest rates are curbing spending.

Markets:

USA

The U.S. government’s commitment of $1.4 trillion over the next seven years to support local supply chains, clean energy, and the semiconductor industry is poised to significantly impact American industry. This influx of capital is expected to stimulate the capital investment cycle and transform sectors like manufacturing and energy. The stimulus is also likely to have a broader economic impact, creating job opportunities and driving demand in related industries. This trend is already visible in 2023, with companies like Carrier Global and Caterpillar experiencing increased demand for energy-efficient systems and construction equipment, respectively, spurred by this federal spending and changing market conditions.

Europe

The common perception that innovation is predominantly driven by U.S. tech giants is challenged by significant advancements in various industries across Europe.

- British-Swedish firm AstraZeneca, known for its COVID vaccine and lung cancer treatment Tagrisso, has made substantial investments in R&D, resulting in a promising pipeline of therapies for oncology and rare diseases.

- Swiss company Sika, a specialty chemical producer, is positioned to capitalize on stricter emissions regulations and increased infrastructure investment with its energy-efficient construction materials.

- France’s Safran, a leading producer of narrow-body aircraft engines, is developing engines with General Electric that could reduce emissions by 20%.

This highlights that while the U.S. continues to be a key player in innovation, Europe offers diverse and promising investment opportunities that can add valuable diversification to investment portfolios.

Japan

Japan is actively working to modernise its corporate sector and place greater emphasis on shareholder interests, a shift from the slow progress seen since the initiation of the ‘Abenomics’ reform program. The Tokyo Stock Exchange has urged companies to enhance profitability, returns, and valuations, particularly by aiming to raise price-to-book (P/B) ratios above one. This can be achieved through strategies like reducing excess cash and divesting underperforming subsidiaries. While this drive has recently propelled Japanese equities to levels not seen since the late 1980s, mainly in value stocks, there’s scepticism about whether this upward trend represents a significant change.

Emerging Markets

The spotlight in emerging markets is shifting beyond China, with countries like India, Indonesia, and Mexico emerging as attractive investment destinations. This shift is driven by rapid infrastructure development, stronger government balance sheets, and changes in global supply chains. Despite China’s slowing economy, emerging markets are gaining depth due to trends like:

- Supply chain reconstruction

- Demographic shifts

- Energy transition

Investment opportunities in these regions are diverse, encompassing sectors like:

- Banking

- Aircraft components

- Real estate

- Mining

- Consumer goods

- Technology platforms focused on consumer services

Despite the broader shift, China remains relevant in the investment landscape, offering opportunities in:

- Innovative companies

- Strong market positions

- Significant cash flows

- Attractive valuations, especially following a deep market sell-off

Australia

The past decade’s investment landscape has been characterized by abnormal trends due to efforts to avert financial crises, resulting in unusually low interest rates and heavy monetary intervention. This environment has skewed the market, favouring speculative behaviours and growth-focused sectors like technology and green energy, leading to inflated valuations for these popular assets. The COVID-19 pandemic further heightened this disconnect between the real and financial economies. Now, as inflation returns and interest rates rise, there’s a growing realization that returns might normalize, moving away from the era of ‘free money.’ This shift suggests that future returns may be more modest and uneven, especially as market trends concentrate around technology and high-growth themes. The investment landscape is also being reshaped by factors like demographics, decarbonization, and deglobalization, which will impact future returns, particularly in areas like renewable energy and infrastructure. Investors are advised to focus on sensible and reasonably valued investments, recognizing that the transition to a more sustainable economy will be complex and may not align with current market expectations.

You can download the entire Quarterly Investment Update HERE

Regards,

Marshall Brentnall, and the AAN Asset Management Investment Committee