Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

As you start to approach retirement, understanding how you can use your super balance effectively becomes crucial.

Each strategy has its own set of pros and cons, tailored to suit different financial goals and circumstances. We dedicate ourselves to helping you through these options, ensuring you embark on your retirement journey with confidence and clarity.

We believe that retirement is one of the most challenging times in someone’s life with lots of decisions and changes being made this can be quite stressful if you are not prepared and have support to get you through it.

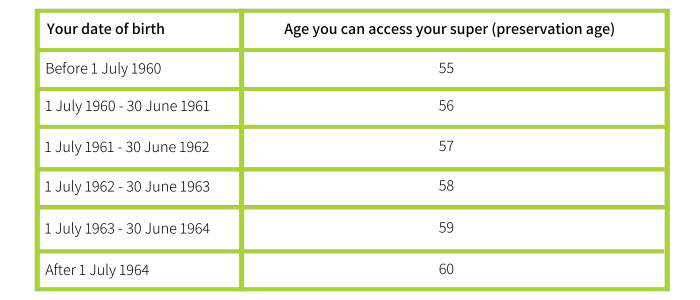

As you start to plan to retire, you are able to keep working and receive payments from your superannuation fund when you have reached your preservation age (55 to 60, depending on your date of birth) and are still under 65.

If you continue to work before you officially retire there is an option to take a transition-to-retirement income stream as well as maintaining your employment income. If you wish to take advantage of this option, you have to ensure you use a minimum of 4% and maximum of 10% of your superannuation account balance each financial year.

This strategy may not be for everyone, and we recommend speaking with your adviser to ensure this can work for your circumstances.

We have outlined below some of the pros and cons of this strategy.

PROS

CONS

This is another option that provides a regular income for you once you have officially retired. You are allowed to withdraw as much as you like as long as you don’t exceed the personal transfer balance cap.

We have outlined below some of the pros and cons of this strategy.

PROS

CONS

As you start to plan to retire or officially retire you may decide to go on that holiday or buy a caravan and travel the country and therefore want to explore withdrawing from your super in lump sums. This is an option if you meet the working and age rules. One thing to consider is that you can opt to take your superannuation out with a combination of pension and lump sum payments.

We have outlined below some of the pros and cons of this strategy.

PROS

Cons

We understand that retirement is a big change for most people as it represents the ending of a phase of your life where you probably spent 30 to 40 years. There may even be uncertainty as to what is next but the one thing to be sure of is that our team will guide you every step of the way.

As your adviser we will consider all options when you are in the yearly years of planning to retire, so you have all the information for when you make that leap and retire.

If you wish to speak to an adviser click here.

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved