Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

Residential property investors have been on a wild ride in recent years as prices slumped during the pandemic then quickly skyrocketed before losing ground again.

Now, with prices levelling out or slowly increasing, there is good news around the corner, according to some analysts.(i)

A combination of positive indicators for housing could help to fuel further price rises.

With a widespread view that the Reserve Bank’s interest rate increases are beginning to work to ease spending, some believe we may see the first rate cuts as early as next March. Add to that the increase in migration and the fall in new house construction, and residential property gains may follow. CBA Chief Economist Stephen Halmarick is forecasting a 7 per cent rise in house prices this year and another 5 per cent in 2024 claiming that, by this time next year, prices will return to “all-time record highs”.

The sustained levels of high demand clashing with historically low levels of for-sale listings are also pushing prices up, according to the Property Investment Professionals of Australia (PIPA).(ii)

In the meantime, some investors are doing it tough with rising interest rates and the end of fixed interest rate mortgages sometimes a contributing factor. The number of short-term property resales made at a loss has jumped, according to property analysts CoreLogic, from 2.7 per cent a year ago to 9.7 per cent in the June quarter this year.(iii) The median loss was $30,000, for houses sold within two years, compared to a median profit of $75,000.

PIPA’s annual survey to gauge property investor sentiment found just over 12 per cent of investors sold at least one investment property in the past year.(iv) Less than a quarter of those houses sold went to other investors, continuing a trend that has been happening for several years.

Almost half of those who sold said they were concerned about governments increasing or threatening to increase taxes, duties and levies.

Where are rents headed?

Will rents continue to rise or stabilise? Experts’ views are mixed about the short-term outlook for the rental market.

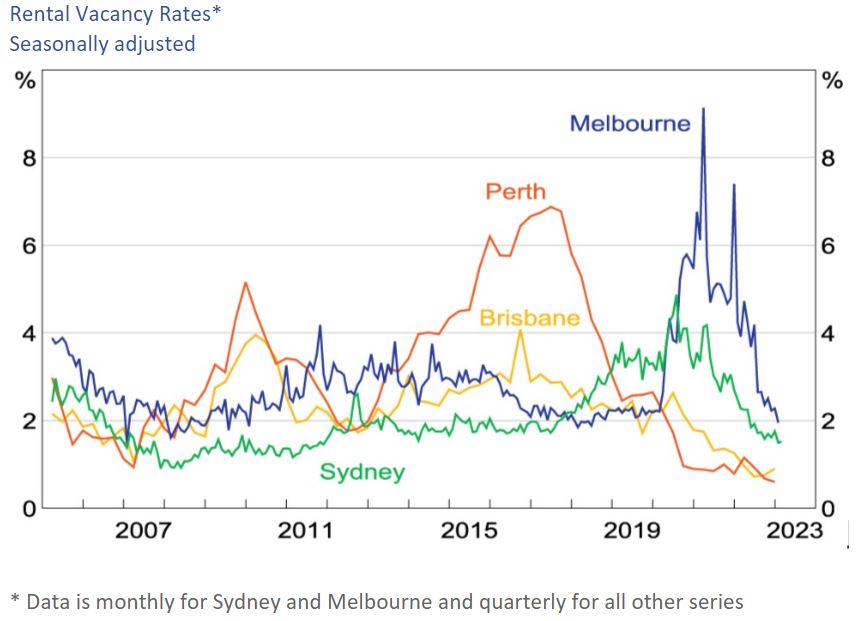

The Reserve Bank says the continuing shortage of rental housing is likely to support ongoing increases in rents.(v)

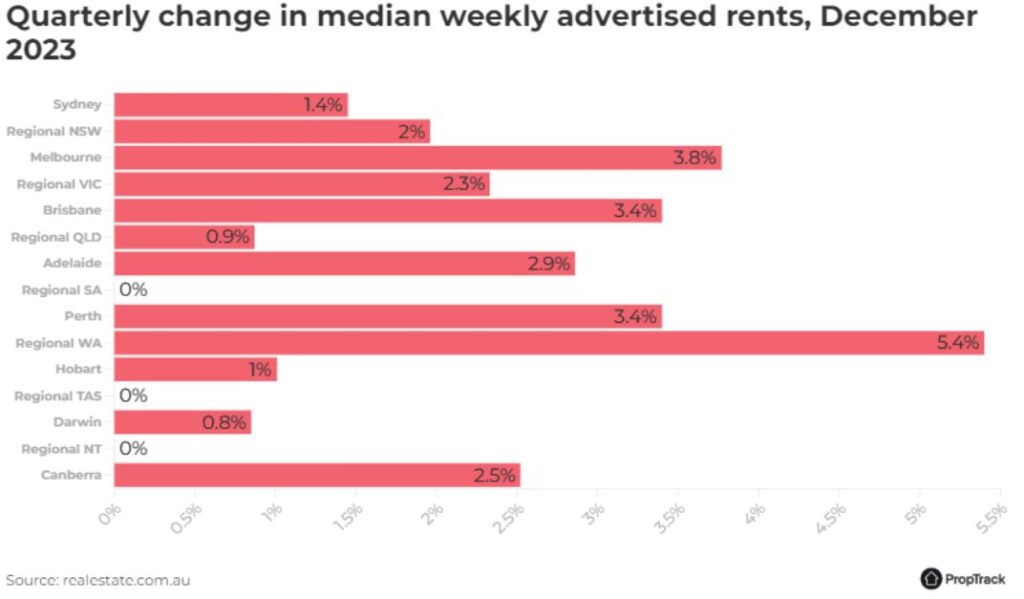

At the end of 2023, the median rent on realestate.com.au was recorded at $580 per week, an increase of 1.8% over the quarter and 11.5% over the year. In dollar terms, median advertised rents nationally increased by $60 per week. (vi)

The Reserve Bank says rents for apartments with new tenants have been more volatile than for houses and townhouses over the past couple of years.

But CoreLogic predicts a slowing in rental price growth next year, saying rents rose for the 35th month in a row in July but monthly growth has eased over the past four months. It says the expected drop in interest rates next year combined with softer income growth and stretched rental affordability will contribute to a slowing in rents.

At the end of December 2023, the median weekly rent for a house was $600 per week. House rents were 3.4% higher over the quarter and 9.1% higher than a year ago. The median advertised rent for a unit was $560 per week in December 2023, 1.8% higher over the quarter and 13.1% higher than a year earlier. (vii)

First homebuyers falling

The recent boom in property prices, the positive outlook and the many assistance programs available from federal and state governments have not been helping those looking to get into the market.

The number of first homebuyers has fallen significantly over the past 30 years, a new study has found.(viii) Published by the Australian Housing and Urban Research Institute, the study says the drop in first homebuyers is down to delayed partnering, higher rates of educational attainment and associated debt, the precarious nature of employment and worsening housing affordability.

The study says various government policy decisions have had little effect on the numbers of first homebuyers.

Build-to-rent growth

Australia’s growing build-to-rent (BTR) market is getting a boost from governments eager to increase housing stock. Various state governments have introduced a raft of incentives for build-to-rent projects, mostly in the form of tax concessions.

BTR projects, common in Europe and North American, see landlords build a large-scale residential development intending to hold it for the long-term while renting the apartments for longer-than-usual terms, often as long as three years with rent increases locked in. Rents are often slightly higher than market averages in return for better communal amenities such as roof gardens and gyms.

Institutional investors, such as super funds, are also getting onboard with the projects, favouring the steady income stream.

While Australia’s BTR market is mostly being driven by large developers and global players, smaller private investors are also getting in on the act. On the plus side, BTR offers regular income, often better returns and the chance to minimise expenses, not to mention the government tax concessions.

On the downside, there is the possibility the BTR concept might not take off in Australia and that vacancy rates may be higher as a result. There is also a downside to the promise of regular income – locked in rental increases may not keep pace with rapid market changes.

Speak to our Mortgage Broker, Kristi Teasel to discuss your property goals.

Sources: REIA; REINSW; REIV

i https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/total-value-dwellings/latest-release

ii, iv https://www.pipa.asn.au/wp-content/uploads/PIPA_Investor-Survey-Report_2023_Final.pdf

iii https://www.corelogic.com.au/news-research/news/2023/short-term-loss-making-resales-on-the-rise

v https://www.rba.gov.au/publications/bulletin/2023/jun/new-insights-into-the-rental-market.html

vi, vii https://www.realestate.com.au/insights/proptrack-rental-report-december-2023-quarter/

viii https://www.ahuri.edu.au/sites/default/files/documents/2023-09/Executive-Summary-FR408-Financing-first-home-ownership-opportunities-and-challenges.pdf

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved