Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

When people think of aged care, they typically think of moving into a nursing home; however people can access care at home to enable to live independently for longer.

However, a crackdown on what the funds can be used for and a shortage of support workers, can make it challenging to understand the funding available.

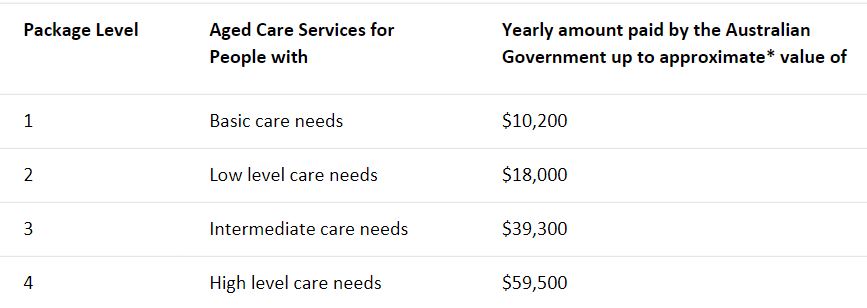

If you are approved for a Home Care Package you will be assessed at one of four levels. These levels acknowledge the different types of care needed. Approval for a package is determined by a health professional from the Aged Care Assessment Team (ACAT) following an assessment.

Current annual funding for packages is $10,271.10 for level one (someone with basic care needs); $18,063.85 for level two (low care); $39,310.50 for level three (intermediate care); and $59,593.55 for level four (high care).(i)

It can take up to six months for a Home Care Package to be assigned following the initial assessment. Once assigned, a provider must be chosen to design a package of aged care services that is best and most appropriate for you – within the home care package guidelines.

Providers charge care and package management fees, which were recently capped at a combined 35 per cent of the package funds.

Income tests apply

The packages are income tested, with part pensioners paying no more than $6,543.66 a year and self-funded retirees paying no more than $13,087.39 a year in fees. Full pensioners do not pay an income tested fee.

An individual’s contribution may not seem like much if you are receiving a high level package and are using all the allocated funds to buy equipment and services to keep you at home. But if your income is high and you are therefore required to pay the highest fees, you may be better off paying privately for one or two services.

Older Australians can apply for a package directly, or through their GP, via the government’s My Age Care aged care gateway.

Due to high demand for Home Care Packages, you may be offered a lower level package while you wait for the one you are approved for. You may also be given access to the entry level government support known as the Commonwealth Home Support Program – where individual referral codes are allocated to you to access interim support such as cleaning, transport or personal care at highly subsidised rates.

Describe your worst day

A good way to ensure approval for the Home Care Package is to describe to the assessor all the challenges faced in carrying out daily activities due to your (or your loved one’s) advancing age.

Key to the process of getting the maximum benefit of a package when it is assigned is the initial care plan, worked out with your provider, which outlines your assessed care and service needs, goals and preferences and details how the care and services are to be delivered.

A revised manual released earlier this year by the Department of Health clarifying what a Home Care Package can be used for is presenting additional challenges for some package recipients looking to maximise what they can get.(ii)

Generally, a requested support or service must meet an individual’s “ageing related functional decline care needs”. The main categories of care and services you can get from a Home Care Package are services to keep you:

Exclusions and inclusions

One area that is becoming more difficult for those with Home Care Packages is gardening – which is one of the most popular subsidised service requests.

Once a regular prune and possibly some new planting was an approved service, but now only minor or light gardening services can be provided and only where the person was previously able to carry out the activity themselves but can no longer do so safely. For example: maintaining paths through a property or lawn mowing.

Other exclusions causing angst amongst recipients are recliner chairs (unless they support a care recipient’s mobility, dexterity and functional care needs and goals); heating and cooling costs including installation and repairs; whitegoods and electrical appliances (except items designed specifically to assist with frailty, such as a tipping kettle).

With an aging population it is no secret that there is a shortage of support workers. While there are government programs to try and fix this, a back-up plan is needed for when support workers call in sick or are unavailable and no replacement can be found.

Most people’s preference is to remain living independently at home for as long as possible. It’s good to start to think about how you’d like to be supported as you age and your health needs change earlier so that you have a clear understanding of your options and a plan that meet your wishes. If you would like to discuss your options to make this happen, give your adviser a call or speak to our Aged Care specialist Melody Edwards.

Government subsidy level for Home Care Packages (iii)

Figures are rounded and current as at 20 September 2023. The maximum government contribution increases each year.

*The individual amount paid will depend on whether you are asked to pay an income-tested care fee.

Source

i & iii https://www.myagedcare.gov.au/help-at-home/home-care-packages

ii https://www.health.gov.au/sites/default/files/2023-04/home-care-packages-program-inclusions-and-exclusions-faqs-for-providers-version-1.pdf

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved