Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

As our superannuation balances grow larger, it makes more sense than ever to keep track of the many rules changes that have recently happened or are coming up soon.

Australians are investing more in super – almost $151 billion dollars in the year ending March 2023, an increase of 11.3 per cent.(i)

Those extra contributions, plus the rebound in the financial markets, have resulted in super assets of around $3.5 trillion.(ii)

And it is being put to good use. We took out lump sum payments totalling $53.5 billion dollars during the 12 months and pension payments of $42.3 billion.(iii)

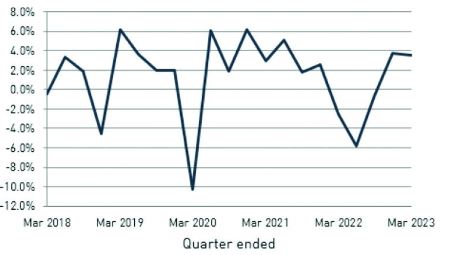

Quarterly rate of return

Source: APRA Quarterly superannuation performance statistics highlights, March 2023

To keep your super on track for a comfortable retirement, check out these latest changes in case they affect you.

Super bonus for workers

For employees, the new financial year kicks off with an increase in the Superannuation Guarantee paid by employers. It is now 11 per cent of eligible wages.

This rate will increase by 0.5 per cent each year until it reaches 12 per cent in 2025.(iv)

The Australian Tax Office will also be cracking down on employers who don’t pay on time or at all. From 1 July 2026, super must be paid at the same time as wages rather than at the end of each quarter.

The recent Federal Budget also provided funds to help the ATO enforce super payments and recover unpaid amounts.

Minimum pension drawdown increased

A COVID-19 measure to reduce the minimum drawdown required on super pensions will end on 1 July 2023.

Investors receiving super pensions and annuities must withdraw a minimum amount each year. The federal government reduced this amount by 50 per cent over the last four financial years to help those wanting to protect their capital as the markets recovered from the chaos of the pandemic.

You can find out more by visiting the ATO’s minimum pension standards.(v)

Transfer balance cap to be lifted

The maximum amount of capital that can be transferred to your super pension will increase to $1.9 million from 1 July 2023.(vi)

The transfer balance cap limits the total amount of super that can be transferred into a tax-free pension account. This is a lifetime limit.

The cap is indexed and began at $1.6 million when it was introduced in 2017. Increases in the cap are tied to CPI movements.

You can see your transfer balance account and cap information in your online ATO account.

Extra tax for large balances

Investors with super balances of $3 million or more will lose the benefit of super tax breaks on earnings. From 1 July 2025, taxes on future earnings will be 30 per cent instead of 15 per cent although they will continue to benefit from more generous tax breaks on earnings from the funds below the $3 million threshold.

This change is expected to apply to around 80,000 people.

Other recent changes

A number of changes announced in both Federal Budgets last year have also been slowly introduced over the past 12 months.

In one major change, the minimum age was lowered for those able to invest some of the proceeds of the sale of their homes into super, known as a ‘downsizer contribution’.

From 1 January 2023, if you are aged 55 or older, you can now contribute to your super up to $300,000 (or $600,000 for a couple) from the sale of their home.

The home must be in Australia and owned by you for at least 10 years.

In another residential property initiative, a scheme that allows investors to use their super fund to save for their first home has been expanded.

The First Home Super Saver Scheme was last year increased from $30,000 to $50,000.

The Scheme allows you to make contributions into your super then apply to release them when you want to purchase your first home, provided you meet the eligibility requirements.

Another significant reform for many has been the removal of the work test for those under 75, who can now make or receive personal super contributions and salary sacrificed contributions. (Although the ATO notes that you may still need to meet the work test to claim a personal super contribution deduction.)

Previously if you were under 75, you could only make or receive voluntary contributions to super if you worked at least 40 hours over a 30-day period.

A further change introduced last year was the removal of the $450 per month threshold for super contributions.

Employers must now pay the super guarantee to all employees regardless of their earnings however, employees who are under 18 still need to work more than 30 hours in a week to be eligible.

While caps have been lifted and programs expanded, at least one scheme has not changed. The Low Income Super Tax Offset (LISTO) threshold remains at $37,000. LISTO is a government payment to super funds of up to $500 to help low-income earners save for retirement.

If you earn $37,000 or less a year you may be eligible a LISTO payment. You don’t need to do anything other than to ensure your super fund has your tax file number.

Finally, a project that may pay off down the track, the Federal Budget included continued funding for a superannuation consumer advocate to help improve investors’ outcomes.

Expert advice is important to help navigate these changes over the coming year. Speak to you adviser for more information.

Sources

i, ii, iii https://www.apra.gov.au/news-and-publications/apra-releases-superannuation-statistics-for-march-2023

iv https://www.ato.gov.au/Business/Small-business-newsroom/Lodging-and-paying/The-super-guarantee-rate-is-increasing/

v https://www.ato.gov.au/Rates/Key-superannuation-rates-and-thresholds

vi https://www.ato.gov.au/Individuals/Super/Withdrawing-and-using-your-super/Transfer-balance-cap/

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved