Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

It’s time to make sure everything is in order for the 2021 end of financial year, so you don’t miss the opportunities that EOFY tax planning can present, particularly for tax savings.

Continue reading to discover our tax planning tips and tasks for the 2021 End of Financial Year.

Click here to fill in our Evalesco EOFY checklist

If you’re keen on taking advantage of potential tax benefits available inside super, or are looking at ways to rebuild your retirement savings the lead up to 30 June could be a good time to act.

Certain contributions, may have the ability to reduce your taxable income, or see you pay less on investment earnings, but remember there will be things to consider.

Superannuation

Lump Sum (one-off) Withdrawals

If you are planning any large acquisitions in July that will require drawing down on your investments, superannuation, or pension accounts, please be aware that most investment managers delay redemptions in the first weeks of the new financial year as they finalise their end of year accounts.

To avoid any issues, we recommend you redeem any cash that will be needed in July, by no later than Wednesday 21st June 2021 – or if possible, defer any large purchases to late July.

PLEASE NOTE: Any regular payments (pensions etc.) will go through as normal. This temporary hold only relates to one-off withdrawals.

Contributions

If you were planning to make superannuation contributions before the end of this financial year, please allow 5 to 7 working days for your superannuation contributions to be processed by your super fund.

We recommend that if you are wanting to make additional super contributions for this financial year please do so by Wednesday 21st June 2021. Please also let us know if you are doing this so we can ensure it is received in time.

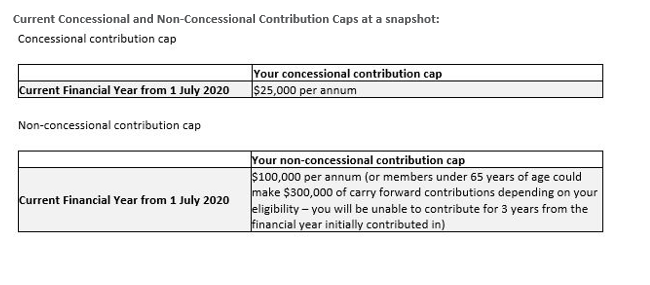

Current Concessional and Non-Concessional Contribution Caps at a snapshot:

Please note: if an individual has triggered a bring forward arrangement before 1 July 2021, they will not have access to any additional cap space as a result of the increase to the non-concessional cap.

Just a reminder that each superannuation fund will have certain cut off dates prior to 30 June for contributions to be made (i.e. contribution must be received by 21st June to ensure it is applied to your account for this financial year) so be sure to be wary of this when looking to make contributions for this financial year or contact your adviser to discuss your options.

Superannuation rules can be quite complex, so for more information regarding what caps and limits apply to you, check our your myGov account, or speak to your adviser about what might be right for you.

Minimum pension payment rates

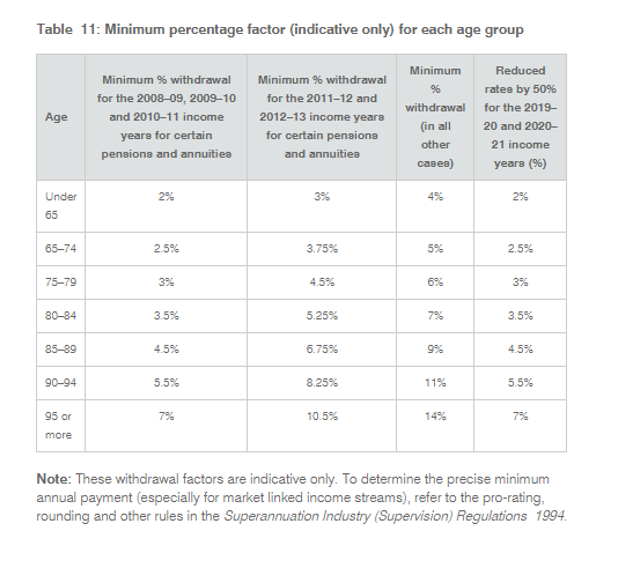

Once you retire and reach your preservation age you can start to withdraw your super as an income stream, a lump sum or both. To assist retirees, the Government has reduced the minimum annual payment required for account-based pensions and annuities, allocated pensions and annuities and market-linked pensions and annuities by 50% for the 2019–20, 2020-21 and (as recently announced) 2021-22 financial years.

Superannuation and annuity providers calculate the minimum annual payment required as at 1 July each year, based on the account balance of the member or annuitant. The 50% reduction will apply to this calculated minimum annual payment.

Prepay your interest and minimise your tax with interest in advance

One strategy available for investors is prepaying interest, known as interest in advance. It is fixing the interest rate on an investment loan at a discounted rate for 12 months and paying the interest normally incurred throughout the year in one upfront interest payment. Usually made in June to ensure the interest deductions is received in the current year.

There are various reasons to pay interest in advance:

Personal income tax cuts and what it means for you

In the 2021 Federal Budget the government announced they would again be extending the Low and Middle Income Tax Offset (LMITO) for the 2021/22 financial year. The 2021 upper limit of some marginal income brackets for individuals have also increased, with:

Full expensing of depreciating assets

Subject to specific rules, both the instant asset write-off (IAWO) and full expensing of depreciating assets (FEDA) is available for taxpayers in 2021.

Businesses with an aggregated turnover of less than $5 billion that purchased and first used/installed depreciating assets after 6 October 2020 can fully expense the cost of:

All businesses with a turnover of less than $5 billion can also deduct in full any amount of improvement costs incurred between 6 October 2020 and 30 June 2021 on existing depreciating assets. Businesses with an aggregated turnover of $10 million or more, or businesses with an aggregated turnover of less than $10 million that do not use simplified depreciation, have a choice whether to apply FEDA or not. However, full expensing is compulsory for businesses with an aggregated turnover of less than $10 million that use simplified depreciation rules.

Loss carry-back measures

2021 is the first year the new loss carry-back measures can be used to provide a refund to companies when they lodge their 2021 tax returns.

Companies with an aggregated turnover of less than $5 billion can choose to carry back their:

If no choice is made to use the loss carry-back measures, the loss is carried forward and can be offset against future profits provided either the continuity of ownership or similar business tests are met.

Immediate tax deduction for start-up expenses

2021 is the first year that medium sized businesses with an aggregated turnover of $10-50 million will be able to claim an immediate tax deduction for:

Previously, these concessions were only available for small business entities with an aggregated turnover of less than $10 million.

ATO extends working from home shortcut method

If you have worked from home this year, the government has extended the working-from-home shortcut method for tax deductions. You can now claim a deduction of 80 cents for each hour you work from home due to COVID-19. Therefore, you only need to keep track of the hours you work from home, along with proof of your expenses.

There are three golden rules for deductions that still apply:

As it stands, the shortcut method can be used to calculate working from home expenses for the following time periods:

It is important to remember that this ‘shortcut method’ may not be suitable for your circumstances and the ATO will still accept the old method of calculating your expenses. For more information on working from home deductions, visit the ATO’s website.

Conclusion

While 30 June 2021 is fast approaching, there is no time to waste when preparing for 2021 end of financial year tax. Now’s the time to be planning to reduce your taxable income and any available concessions you may be eligible for.

The best tax planning tips our advisers can offer is to keep up to date records, know what deductions you can claim, utilise the instant asset write-off.

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved