Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

Dear Investor,

2021 presented a year of ups and downs for most of us. The ups included a strong start for the Australian economy and markets, with Australia’s strong quarantine system buffering us from a new highly contagious Covid-19 variant labelled Delta. Our unique approach to quarantine allowed our economy to flourish, and jobs boom. However this was short lived, with a single breach in quarantine practices mid-year having Delta spread quickly throughout our two largest states. This created misery once again as harsh lockdowns to manage the virus separated us from loved ones once more. The way out was vaccination, and Australians rolled up their sleeves and took up the challenge with determination.

Thankfully with the onslaught of the new Omicron variant, Australians are now largely prepared, but the same cannot be said for other nations oversees – which presents a danger to global growth and markets. It is at this juncture we remember the old saying a watched pot never boils. The adage points to watching something continually, which can make it feel like it is never going to happen (or boil). Is there a correction coming in investment markets? The answer is “always”, but we will never know when exactly.

The cyclical nature of investment markets has not changed and the momentum caused by ‘fear and greed’ is not driven by fundamentals but by psychology; and that’s why it is very hard to predict.

Australian and international share markets have had a very positive 12 months and property markets have had the same. Over the last three years, we have seen some major fluctuations but the average return has been very strong when compared to inflation

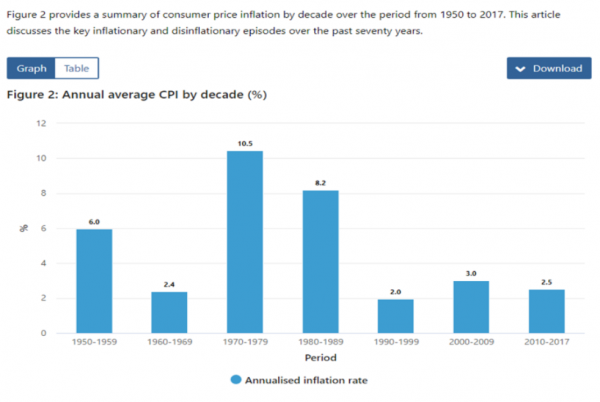

We look at inflation and talk in terms of CPI + returns, as they are “real returns”, i.e. net of inflation. In the 70’s the average inflation rate was 10.5% and the 80’s 8.2% (See chart). This meant any investment return had to be well above this to keep pace with the rising cost of living, otherwise your wealth would essentially erode in value.

In terms of the present, while there is strong evidence of inflation rising both here and abroad, your investments continue to perform.

We’ve had some very strong returns generated from our underlying active and ‘smart beta’ managers, contributing to the above average returns of our models.

It’s natural at this juncture for investors to start to consider how much more can these positive returns run? Experience has taught us to be looking for the “correction surprise”. Without trying to provide a lesson on portfolio management theory, we would argue the ‘buy and hold’ strategy has its problems and that is why your AAN Asset Management portfolios and models, reweight quarterly.

If a sector such as Australian shares or commercial property has a strong quarter, we ‘reward’ that sector by reducing them back to our portfolio benchmark and spreading their accumulated outperformance across the other sectors in the portfolio. Essentially you are taking profits every quarter and redistributing them across the whole portfolio.

If you just ‘held’ that sector your portfolio would become overweight in that sector and increasingly add concentration risk. Additionally, your investments are held in various styles of management which can perform differently based on the environment. For instance;

Why are we telling you this?

Markets are stretched and despite some commentators talking about ‘transitory’ inflation, the broader market has now moved to anticipating inflation driving interest rate rises in 2022; something we, and our analysts have been anticipating since June.

That pot has been simmering away while you have been reading…!

The good news is we have already been managing this in your portfolio:

Yes, we are doing the worrying for you, and as normal, what you read in the news cycle has already been part of our thinking for some months.

As always if you have any concerns talk to us as there are things we can do to further reduce risk, but you can sleep easy knowing that many of the moves we would discuss are already being factored in to your portfolio.

Quarterly market overview

Markets over the quarter reacted to the identification of a new covid-19 variant (late November) and surging inflation in the US (above 5%) which lifted it to 30 year highs. Prior to this, markets and US Federal Reserve shrugged off these concerns, citing drivers were ‘transitory’ (as opposed to persistent) and expecting it to “cool off”.

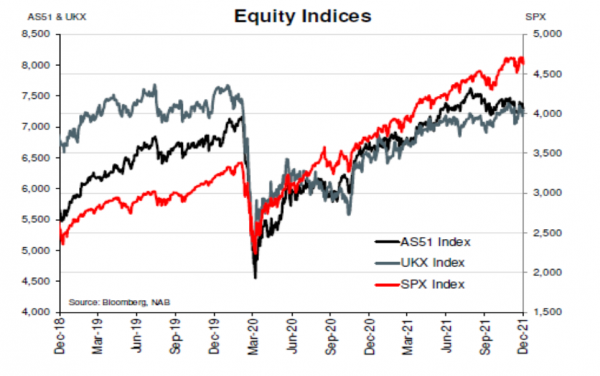

Despite inflationary concerns and risks of monetary policy tightening, the uptrend in equities took the global equities to a new record high on 16 November. However, it was the fifth Covid wave which made equity markets falter, as some European countries were hit particularly hard.

The final straw was the emergence of the new Omicron variant in Africa, and the news of which provoked a sharp and widespread equity sell-off toward the end of November.

In Europe, ECB President Lagarde said that their three conditions for raising rates “are very unlikely to be satisfied next year” as “the outlook for inflation over the medium term remains subdued”, meaning it was unlikely they would change settings any time soon.

China had tightened its monetary policy a while ago to enable “aggressive deleveraging” as it sought to slash debt in the property sector. However the final quarter saw some of the effects of deleveraging come to the fore as Evergrande took out the title of most indebted property company as it neared collapse. A covid relapse saw whole cities (of 17m people) being locked-in caused housing sales and consumer spending to slow sharply.

December saw the US central bank change their language, and markets therefore begin to price in rate rises and a reduction in the easy money conditions of 2021 (and most of the decade). As a result, long duration assets like bonds posted negative returns, with value stocks and property largely benefiting.

In Australia, it was confirmed that our economy went backwards in the 3rd quarter with growth numbers (GDP) confirming a 1.9% contraction as NSW and Victoria were largely in lockdown during the period.

While the news appeared bleak, GDP is an historic data point, and Australian forward looking activity indicators pointed to a very strong snap back in the final quarter for 2021.

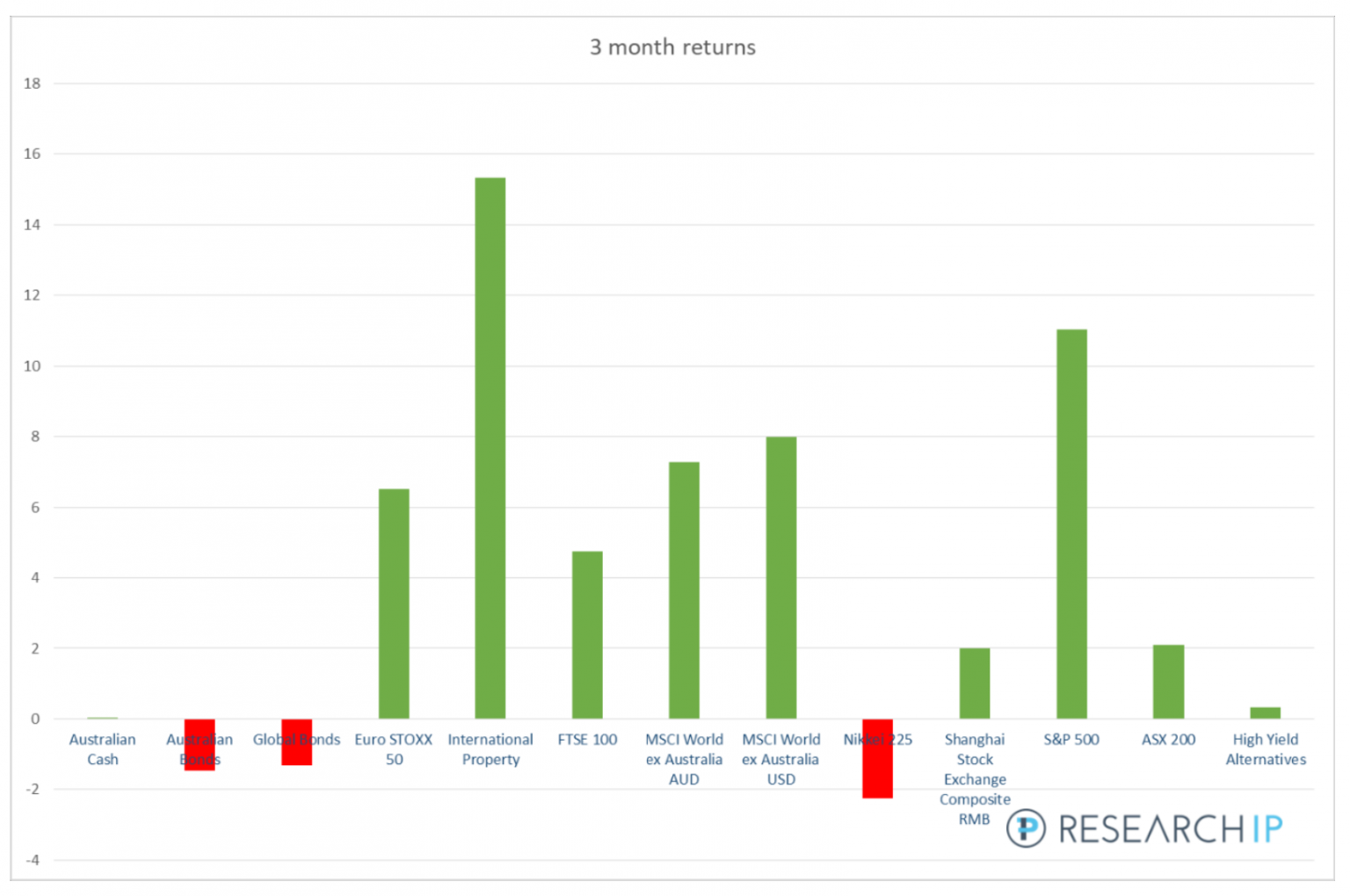

The chart below shows the strong performance for risk assets over the quarter. They continued to benefit from long term low interest rates which helped pushed equity markets forward. US equities continued to set the pace and European markets staged a late rally. Japan was the worst performing equity markets, while emerging market bonds also fell as interest rates in many countries increased.

Over the calendar year, International Property returned 40% as lockdowns largely lifted, international equities (unhedged) returned almost 12%; boosted by a weaker Australian dollar. Australian bonds lost almost 3% as rates rose, and global bonds were little changed, returning 1%. Overall, 2021 provided strong returns for most balanced investors with relatively low volatility.

With so many people and economies in different phases of lockdowns and restricted in traditional discretionary spend items such as travel, new cars etc, we ended the year with excess savings of around $2.3trn in the US and $250bn in Australia. This has provided a buffer for many and will provide an ongoing boost to spending.

Outlook

The identification of the omicron variant provided a reminder that the pandemic might not yet be over. Just as importantly, the persistence of inflation surprises (particularly in the US) is causing central banks to reassess the urgency with which they unwind current extreme monetary policy settings.

In 2022, the consensus for the global economy is:

The spread of the omicron variant will be closely watched in the weeks and months ahead. These considerations will be a significant factor for global central banks including Australia’s RBA and the US Federal Reserve. Inventories continue to be low because of various supply chain disruptions, and will need to be rebuilt which will provide a boost to production.

NAB are forecasting Australia’s GDP growth for the year to move from 1.6% to 2.6%, and expect above trend growth to continue through to next year, before returning to a longer-term trend level (around 2.5%) in 2023.

Meanwhile the RBA continues to buy bonds to the tune of $4b per week and will continue to do so until February 2022. This is despite a very strong labour market (with unemployment back at a low 4.6%) and high savings rate (20%) making consumers healthy and happy to spend.

Following the house price growth of 22% in 2021, prices are expected to continue to slow into 2022 (to around 5% by year’s-end). NAB say “This will set up a weak 2023 and if, as we expect, the RBA lifts the cash rate in H2 2023, we would expect to see a fall in house prices of around 7.5% over that year.” Other factors influencing the market include APRA’s changes to loan serviceability buffers, as well as higher rates.

Looking forward, the latest Covid, fiscal and monetary policy developments are clouding the view for investors; raising many questions and uncertainties for markets which means the current phase of volatility is likely to continue through the New Year.

Global economic growth is expected to moderate in 2022, but an upward lift in inflation pressures is expected to see a number of central banks, including the US Fed, end QE programs and lift official interest rates in 2022.

Regards,

AAN Investment Committee

You can download the entire Quarterly Investment Update HERE

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved