Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

Financial scams are more aggressive and harder to detect than ever. According to the ACCC, Australians lost more than $65 million in 2020 to investment scams and around $114 million in the first 10 months of 2021.

In a sign of more trouble to come, consumer losses in the UK for investment scams exceeded AUD $1.85 Billion in 2020, with the internet delivering most of the devastation.

“Low interest rates are leading people to seek higher returns on their cash. However, scammers are appealing to this desire. The proliferation of information online means it can be hard to discern between real investments and scams,” says Jeff Thurecht , director at Evalesco Financial Services in Sydney.

Why Financial Scams Are on the Rise

Investors might feel that they are savvy enough to detect investment pitches that are “too good to be true,” but the reality is that scammers know this and have focussed on people looking for just 1% more than a traditional bank.

The low interest rate environment since the beginning of the pandemic, and the power of the internet have unwittingly exposed investors to financial crime all over the world.

We’ve gotten used to new names like ‘uBank’ and ‘Xinja’ and ‘RaboBank’ who promise to ‘disrupt’ the old banks with better rates. The proliferation of new brands and sites means that it is hard to discern between real investments and scams.

Investment Scams: Straight to the Money

Although identity theft is the most common scam type, for criminals it can be a lot of work as it drags on and can take time to execute. Investment scams on the other hand take the criminal directly to the money and with one transaction, the scam is executed.

In most investment scams, the money is wired off-shore as quickly as possible and is impossible for Australian authorities to retrieve. Scammers operate from afar through the power of the internet, never physically touching Australian soil. Law enforcement authorities are country focused and the Australian Federal Police have no authority to chase criminals in other countries.

Investment scams ballooned in 2020 as individual investors started chasing returns with their own financial research and many people were harvested by scammers who presented safe investment accounts online.

Google was a key destination for individuals to do their research to find bank accounts and investment products which might offer a return of over 3%, which is in line with the falling yields of traditional bank accounts.

With that in mind, scammers set out to make beautiful websites with convincing names and advertise at the top of Google results offering modest returns of 3, 4, or 6% in savings accounts with new “4.5/5 star reviewed and approved” banks or building societies.

These new sites showed positive reviews (fake) and awards (fake) all over the website and even had regulatory approval numbers published in their footer (also fake).

However, in the UK, 90% of investment ads were fake according to Mark Taber, a campaigner against financial scams.

Consumers would sign up and transfer their money to the new account and never see it again.

Regulators in the UK saw the same thing. The Financial Conduct Authority warned Google 1,200 times in 2020 about scams that were advertising at the top of Google search results and stealing money. That’s four warnings every one business day against scammers in Google’s advertising results.

The Internet is an Investor’s Wild West

Twenty twenty was the wild west for investment scams. Although Google has begun to crack down on some criminal operators, it will just force these operators to use other advertising platforms.

In this environment, there’s no better way to identify potential scams than to work with trusted friends, advisers and experts as almost everything can be faked online. Thurecht recommends financial advisers as a form of protection.

“Financial advisers have a distinct advantage when it come to helping people protect themselves from scams. We spend much of our time time reviewing portfolios and different products. As such, we have a consistent, robust and repeatable methodology for assessing investments,” said Thurecht. “We have access to research from multiple professional sources and they often have approved product lists, which means that they have already filtered out substandard or inappropriate products”.

“A general rule in investing is that the higher return you are aiming for, the more risk you are taking on. It’s important to understand the product you’re considering; what is the underlying asset (i.e., shares, property, cash, bonds, etc.), and do some comparisons as to what the current returns are for that asset class,” continued Thurecht. “For example, regular cash accounts are paying much less than 0.5% interest, so if an account is purporting to be cash, or cash-like, and they are offering 3%, then you should pause and look further as it sounds like this might be a higher risk product.”

Just as it is important to be vigilant when considering investment opportunities, the same level of caution should be taken when selecting a financial planner.

In Australia, financial planners are regulated by ASIC and it is easy to check on the ASIC’s Moneysmart website that they are registered and have a current license.

Australian Advisers must:

“By ensuring the adviser you choose to work with is properly authorised, you are increasing the oversight on the advice that you are provided and the protection you have if something goes wrong,” said Thurecht. “Which means there is less chance of it ending badly for you.”

Financial scams are a big issue. Many scams are run by overseas criminal groups, so if you lost money in a finance scam, your chances of getting it back are very low.

The Good News

Teaming up with a skilled financial adviser can help investors find products that match tolerance for risk and long-term goals as well as provide a dispassionate sounding board to help differentiate between suitable investments and scams.

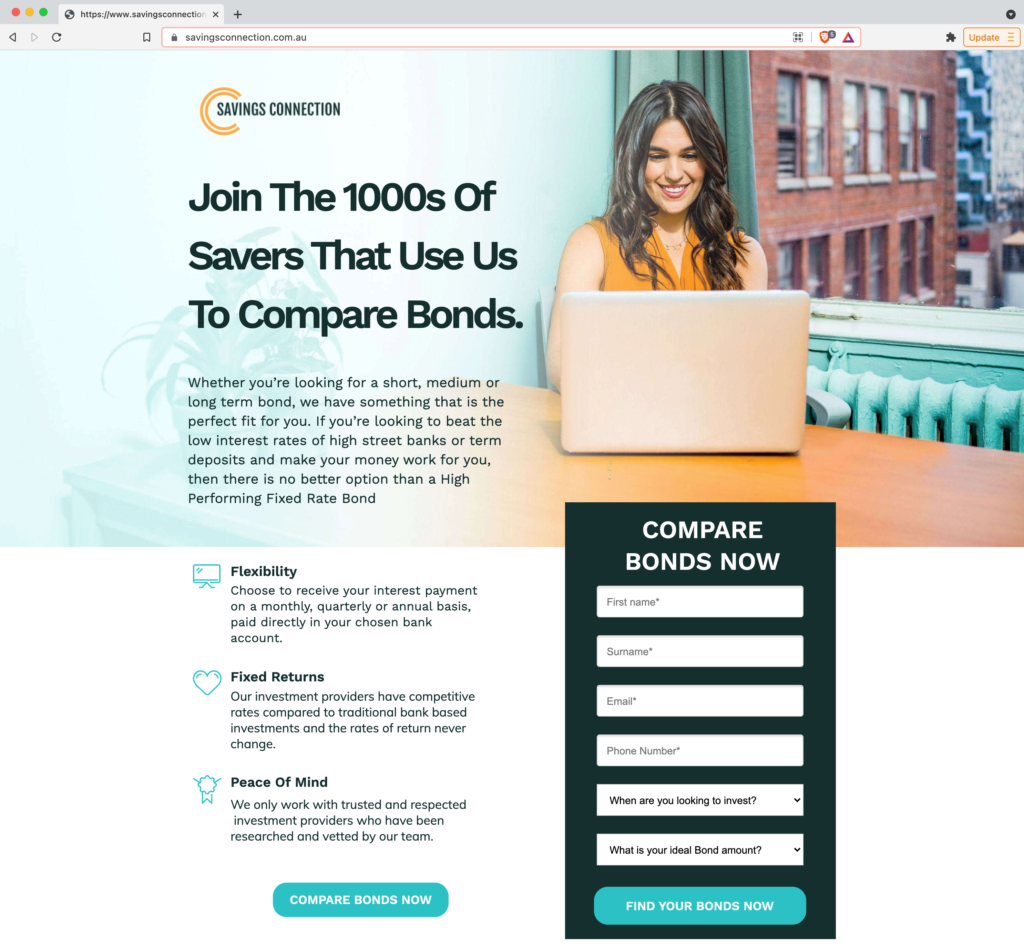

Unfortunately, scam sites are very hard to detect. The below example deceived many Australians and was present in Google ads from December 2020, operating under the name compare-investments.com.au. It was a fraudulent company designed to steal investments and is no longer in operation.

This site operated in Australia from December 2020 and was a scam site to steal from investors

Financial Advisers: A Defense Against Scams

Financial advisers provide a line of defense against these “fly by night” scams as they only work on products that are listed for investment in their license.

“Financial advisers work from an approved product list. A financial adviser would most likely not recommend investment in products outside this list,” said Phil Anderson from the Australian Association of Financial Advisers.

Even when searching for a financial adviser to protect yourself, you might fall for a scammer. Simply searching “financial adviser” on a search engine could take you down the wrong path into the hands of a scammer.

It is important for consumers to check that an adviser is registered with ASIC and that they have a current license. You can use the ASIC financial planner register to double check a prospective adviser’s qualifications, experience and work history.

However, do not rely on the adviser’s website alone. Ensure that you check with ASIC first.

You can investigate the services offered by an adviser, prior to meeting them, by requesting a copy of the planner’s Financial Services Guide. This outlines fees, services and whether the planner gets paid commissions or is associated with any financial institutions such as banks.

Thurecht suggests asking an adviser about:

How to Fact-Check Adviser Returns

Each financial advisory will talk to you about your plans and your desired investment returns over a time frame.

If you are an individual investor looking at investing in stocks, common indexes like the ASX 200, S&P 500, the Nasdaq 100, and the Dow Jones give an indication of the what the market is doing and are a useful starting point to establish a baseline.

Many investors use ETFs as a benchmark for investments as they include baskets of stock and can mirror and index (like the ASX 200) or can mirror the performance of a sector (like financials or biotech).

New Types of Investment Scams to Watch Out For

Some of the most common investment scams include pyramid schemes, ponzi schemes, free investment seminars and imposter scams.

Traditionally Australians would pride themselves on being able to spot a scam by looking for things like cheap designs, no reviews, or too-good-to-be-true promises. However, scammers now know that these are telltale signs, so they have actively tried to look like slick startups.

Here are a couple of recent examples:

Fake Comparison Websites

A recent investigation by the Australian Financial Review found newly established fraudulent websites are being promoted via Google to lure investors into investing their savings which are siphoned off into untraceable cryptocurrencies.

While Google told the AFR that they were investigating and taking down the scam websites, a quick search reveals that the scammers have responded by producing new sites. The first ad result when searching “high yield bond comparison” in Google is SavingsConnection.com.au.

In March of this year, the FCA in the UK published a warning about Savings Connection telling consumers, “We believe this firm has been providing financial services or products in the UK without our authorization.”

FCA issued a warning about Savings Connection

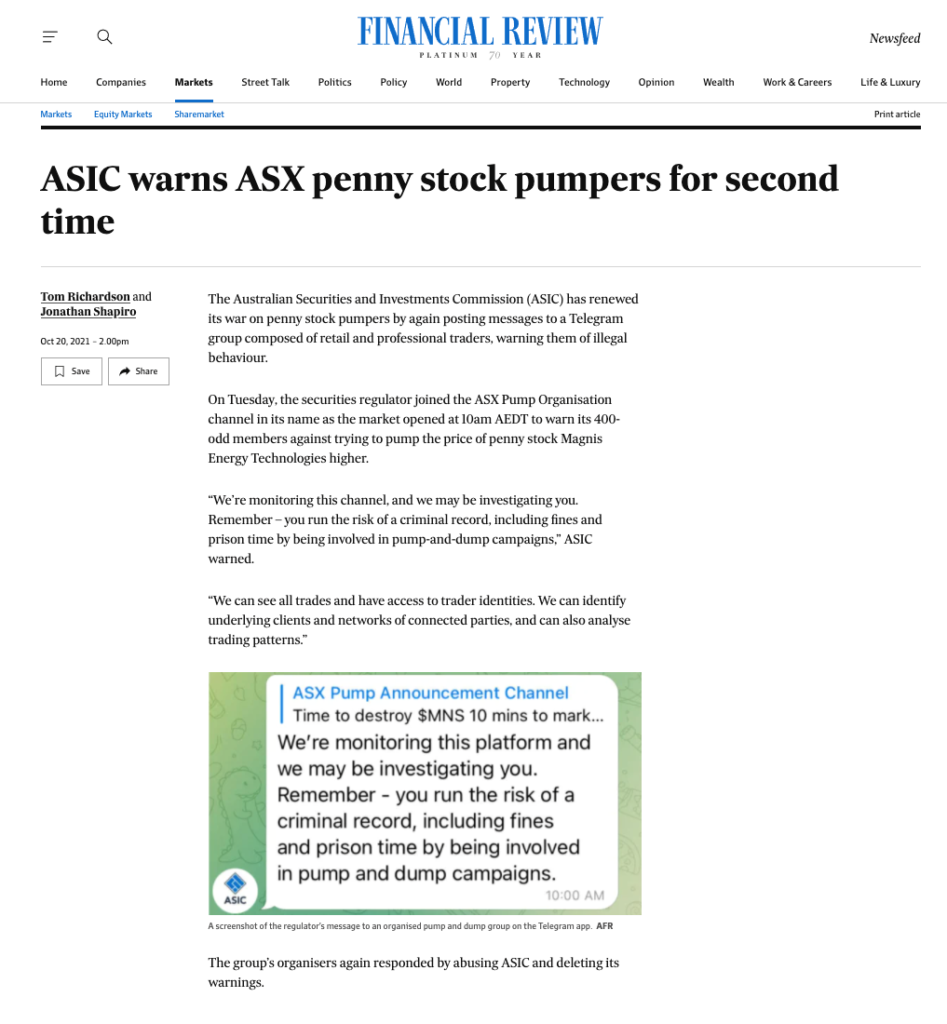

Pump & Dump Stock Groups

Pump and dump schemes have been around for decades and involve pumpers who buy an asset for cheap and promote the prospects of an investment to drive up the price, then quickly dump all their stock while the price is high.

Typically these schemes involve forums, WhatsApp groups and Telegram groups. Be wary of people promoting their investment, as you never know what is on the other side.

Pump and dump groups have received multiple warnings from ASIC

Cryptocurrency Pump and Dumps

A recent study from UTS business school showed evidence that pump and dumps are rife in cryptocurrency markets.

Cryptocurrency pump and dumps work in a similar way to traditional stock schemes, however the barriers to entry are much lower. Creating a new cryptocurrency is pretty simple, which makes it a hotbed for scammers to create new coins which are basically unregulated. Scammers can hype them by making all sorts of claims, and when they dump, they leave investors with a worthless token.

While the stock market is regulated by ASIC, and perpetrators can face serious criminal penalties, cryptocurrency poses a much more difficult challenge due to the anonymity of investors and the fact that it not controlled through a third-party like a bank.

This article was written by Cameron Craig and posted on the www.verified.org website.

Sources

Australian Financial Review: ASIC warns ASX penny stock pumpers for second time

Australian Financial Review: Google’s unwitting alliance with scam operators

Australian Financial Review: Millions vanish into crypto world in high-yield bond scam

Australian Financial Review: Scammers shift to spruiking blue chip bonds

Australian Financial Review: Google promotes bond scam amid police probe

The Independent: 90% of Google adverts for ISAs and bonds may be scams, search giant told

The Register: Financial watchdog says Google’s clampdown on scam ads might not be enough to prevent stricter laws in Britain

BBC: Google cracks down on financial-scam adverts

Google: Further measures to help fight financial fraud in the U.K.

Google: Helping protect people from financial fraud in the U.K.

Evalesco Financial Services

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved